Important Links

The Challenge

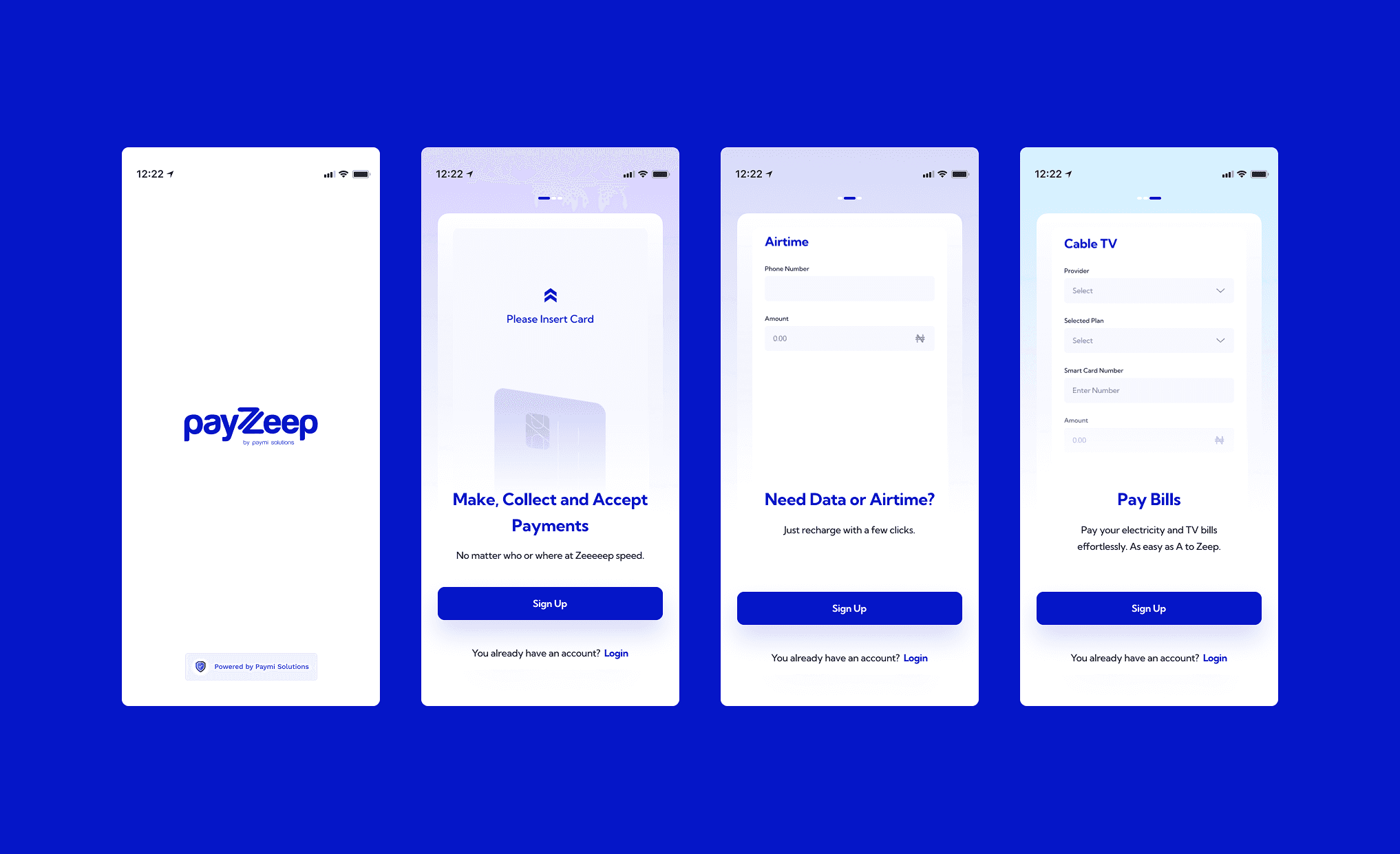

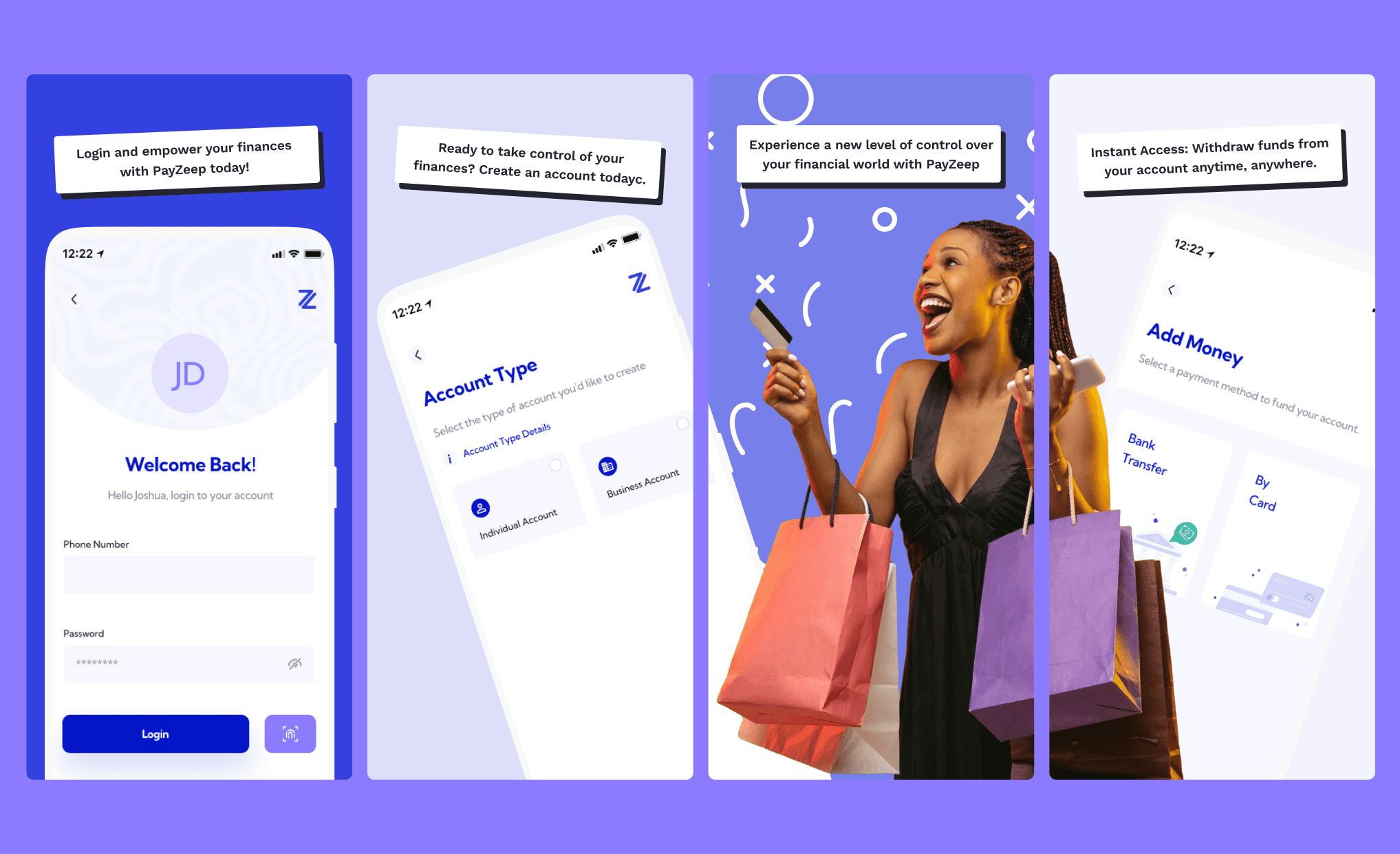

Digital payments in Nigeria can feel fragmented and unreliable. Users often face failed transactions, unclear feedback, and complicated onboarding flows. Many fintech apps prioritize functionality over experience, leaving users confused or mistrustful. At Payzeep, the goal was to design a mobile app that not only worked seamlessly but also felt safe, transparent, and easy to navigate, especially for first-time fintech users handling everyday transfers, bill payments, and wallet funding.

Research & Insights

I analyzed top fintech platforms in Nigeria and across Africa to understand where Payzeep’s mobile app could stand out. While many competitors offer strong features like cross-border transfers or super-app functionality, they often fall short in areas like ease of use, transparency, or trust. These findings shaped Payzeep’s focus on a simple, fast, and reliable mobile experience.

Paystack

Known for its smooth checkout experience and developer-friendly APIs, Paystack supports card, bank transfer, and USSD payments. However, its mobile wallet features for individual users are still limited.

Flutterwave

A robust platform for merchants to accept payments across Africa and beyond. While strong on backend infrastructure, Flutterwave pays less attention to everyday mobile usability for individual users.OPay

Offers a full suite of financial services including transfers, loans, and bill payments through its mobile app. Despite its wide adoption, users have raised concerns about KYC clarity and trust in the platform.Moniepoint

Specializes in POS and business banking tools. It has made great progress in merchant services but offers fewer personalized features for individuals managing personal finances on mobile.

The Solution

The final design was a clean, intuitive mobile experience that brought together essential financial actions into one unified app. Each feature was built with clarity, speed, and user trust in mind.

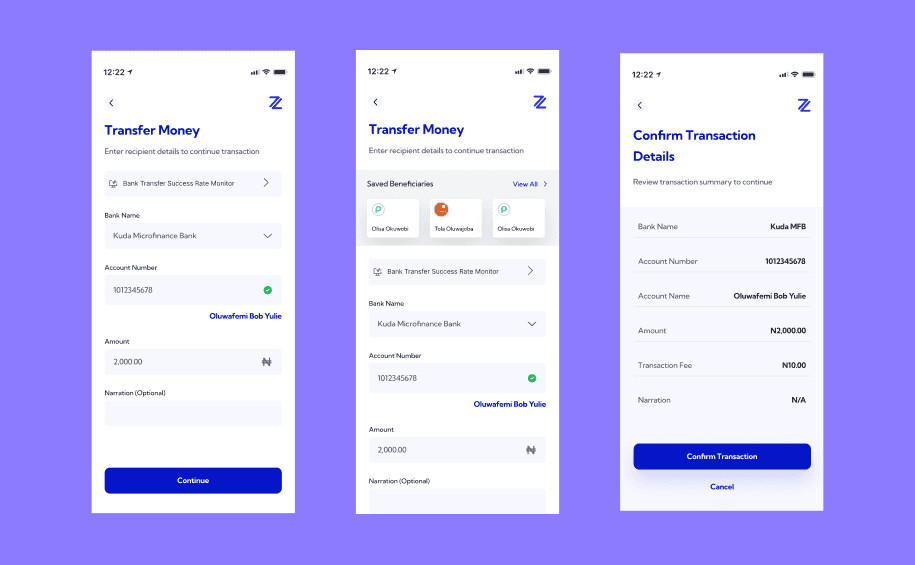

Money Transfer

Bank Transfers: Users can send money to any Nigerian bank account with upfront fee visibility and instant confirmation.

Saved Beneficiaries: Transfers to frequent contacts are faster with saved profiles and auto-filled details.

Transfer History: A clean, filterable log helps users track every transaction in real time.

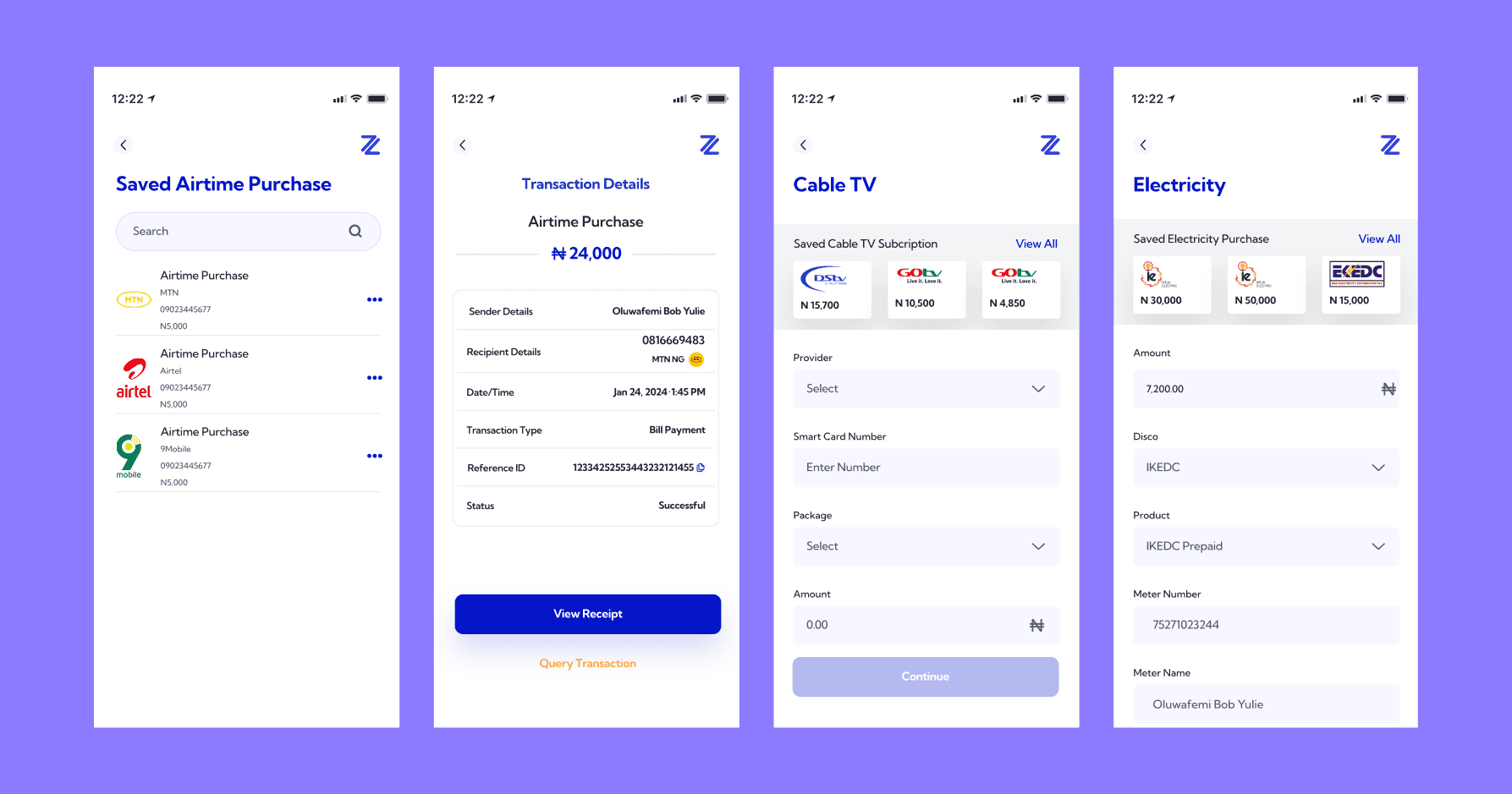

Bill Payments

Airtime & Data: Easily top up any network with clear pricing and no hidden charges.

Utilities: Pay electricity and cable TV bills directly from the wallet with receipt confirmation.

Saved Beneficiaries: Transfers to frequent contacts are faster with saved profiles and auto-filled details.

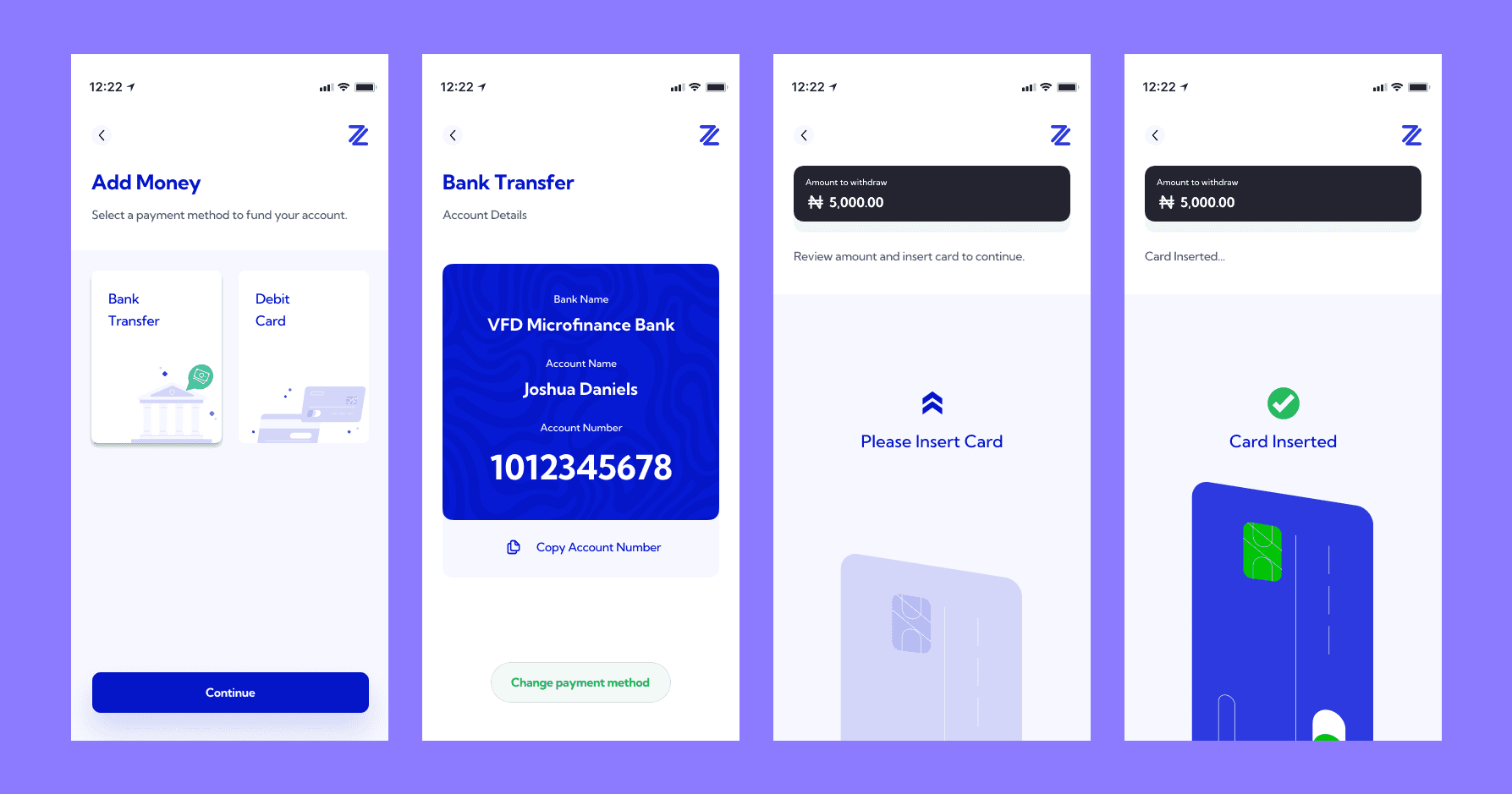

Add Money

Bank Transfer or Debit Card: Users can fund their Payzeep wallet either by sending a transfer to their unique virtual account or by linking a debit card for instant top-ups.

Secure Transactions: All funding activities are encrypted and require PIN or biometric confirmation to protect user accounts.

Real-Time Updates: Once a transfer or card payment is completed, the wallet balance reflects the new amount instantly

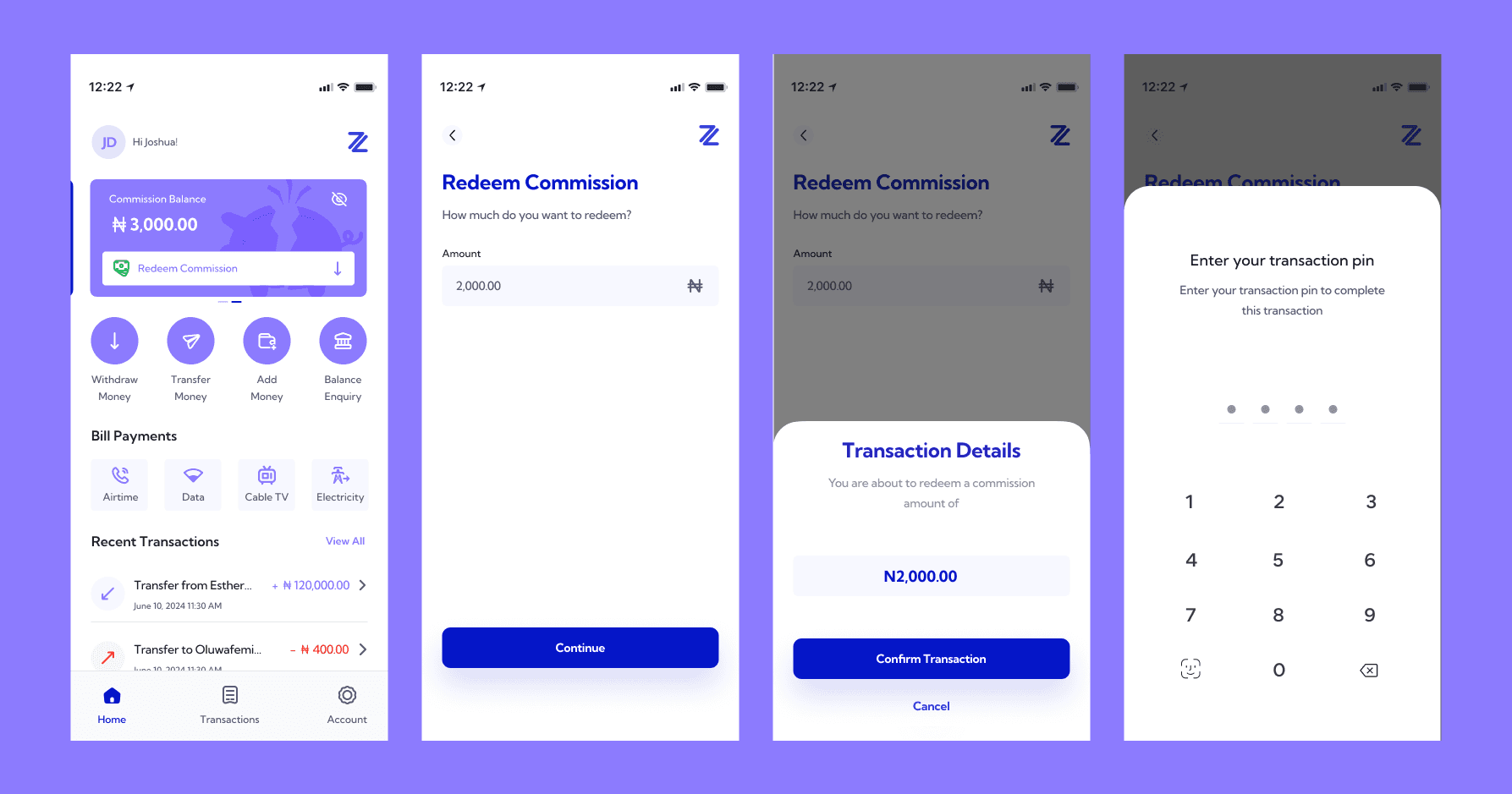

Commission

Earned Rewards: Users earn commissions from referrals or completing key actions within the app, such as inviting new users or reaching transaction milestones.

Redeemable Balance: Commission earnings are separated from the main wallet but clearly visible, with a dedicated section for tracking available rewards.

Flexible Use: Users can either redeem commissions as cash into their main wallet or use them directly for transfers, bill payments, or airtime top-ups.

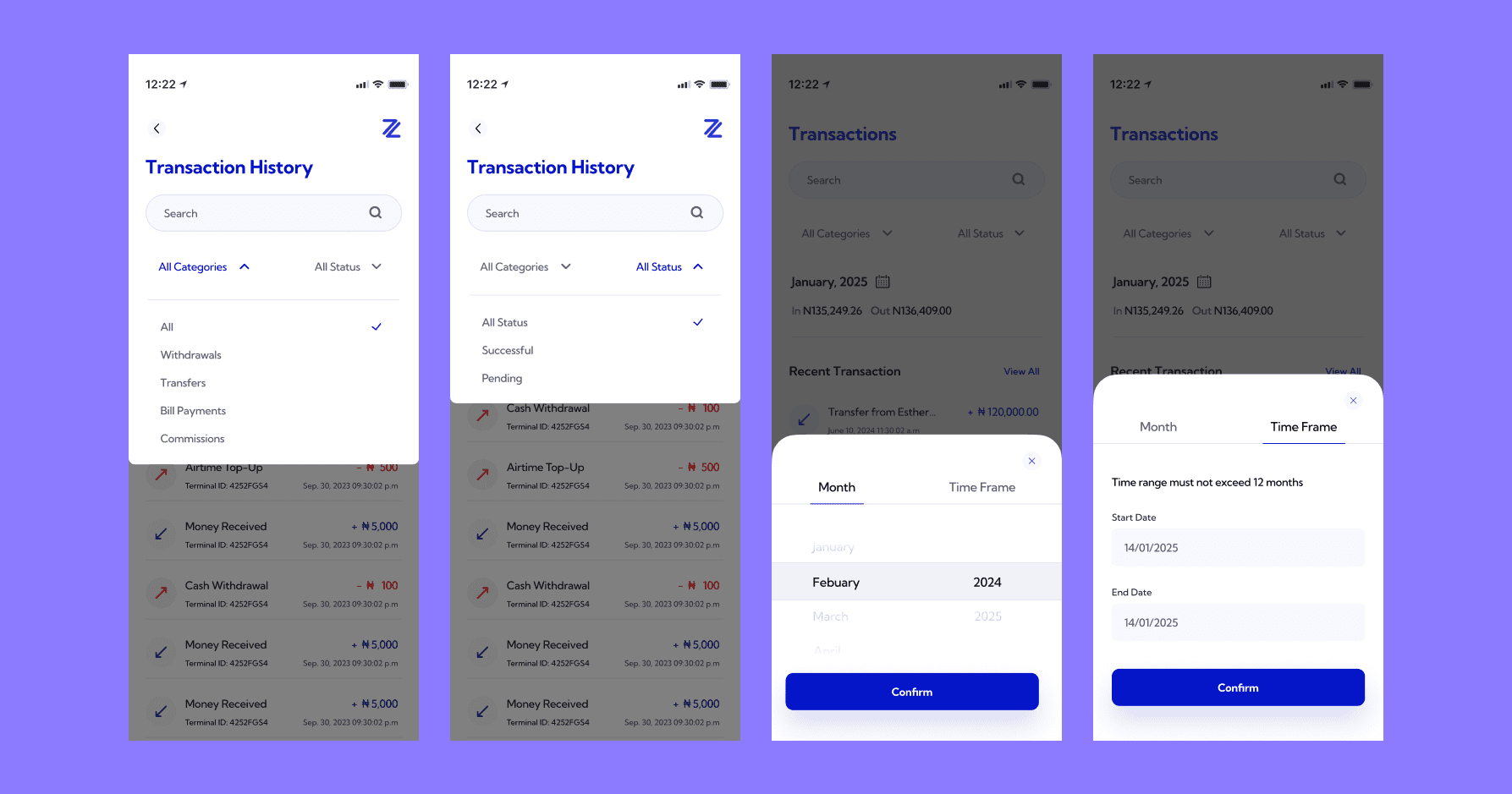

Transaction History

Clear Record Keeping: Every transaction—whether a transfer, bill payment, or wallet funding—is automatically logged in a dedicated history section.

Filter & Search: Users can filter by date, transaction type, or status, making it easy to find specific records when needed.

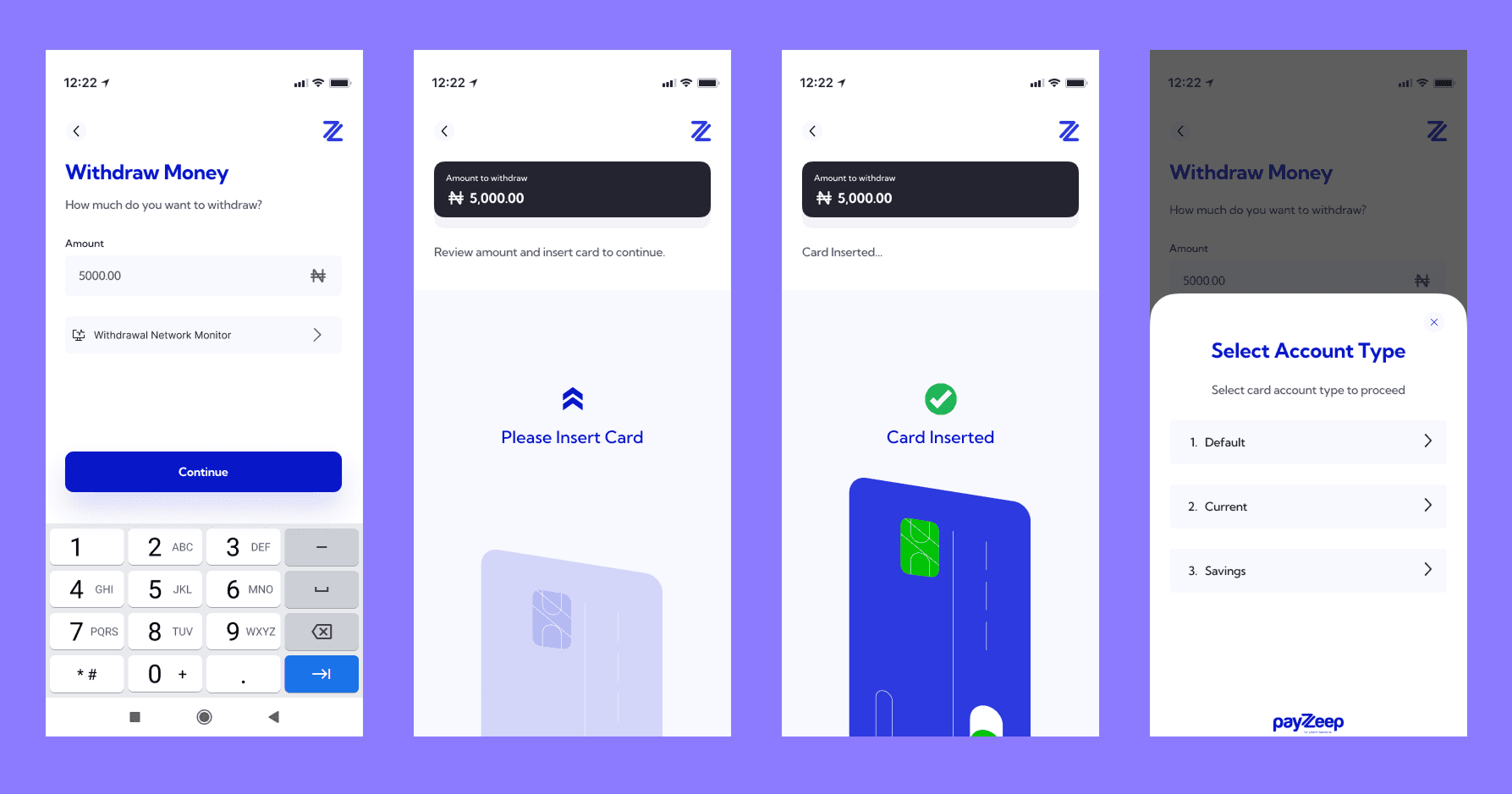

Withdraw Money

Instant Card Withdrawals: Users can withdraw funds from their Payzeep wallet directly to a linked debit card.

Fast Processing: Withdrawals are processed quickly, with most transfers completing within minutes.

Status Updates: Users receive real-time notifications and can track withdrawal status in the transaction history.